what is suta tax rate

Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes. Generally states have a range of.

6 Ways To Control Your Unemployment Tax Costs Marks Paneth

What is the SUTA rate for 2021.

. The contribution rate. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages. As a result of the ratio of the California UI Trust Fund and the total wages paid by all.

The current taxable wage base that Arkansas employers are required by law. How long you have. Most states send employers a new SUTA tax rate each year.

065 68 including employment security. 065 68 including employment security. State unemployment taxes are paid to this Department and.

The FUTA and SUTA taxes are filed on Form 940 each year. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual. In most cases there is a minimum and maximum rate which ranges based on the following criteria.

Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. SUTA isnt as cut and dry as the FUTA as it varies by state. Keep in mind that the federal tax rate can only be reduced upto 54 of the SUTA tax rate.

State SUTA new employer tax rate Employer tax rate range SUTA wage bases. State SUTA new employer tax rate Employer tax rate range SUTA wage bases. The amount of the tax is based on the employees wages and the states unemployment rate.

Fortunately most employers pay little SUTA tax if they. States that raised unemployment tax rates for 2022 and their new ranges include. How Are SUTA Rates.

For any employee who earns more than 7000 annually youd multiply 7000 by 006 to get 420 which is the maximum youll pay in FUTA taxes for any employee. State unemployment tax rates. If you pay your.

For instance if your state rate is 3 the FUTA rate will also be 3. The new employer SUI tax rate remains at 34 for 2021. State unemployment tax rates.

You can find these by checking your states unemployment. Some states have kept unemployment tax rates level but raised the state taxable wage base. This is the SUTA tax rate set by your state.

As a result of the ratio of the California UI Trust Fund and the total wages paid by all. Each state usually sets a minimum and maximum rate and your business will fall somewhere within that range. What is the SUTA tax rate for 2021.

51 rows An employers SUTA rate is often referred to as a contribution rate. Any amount your business pays in SUTA tax counts as a small business tax deduction. What is the SUTA tax rate for 2021.

Content New Employers Meet your Year End Filing Deadline with 123PayStubs Payment of SUTA tax to State Is SUTA the same as unemployment tax. The new employer SUI tax rate remains at 34 for 2021.

Solved Mc Qu 99 The Current Futa Tax Rate Is The Current Chegg Com

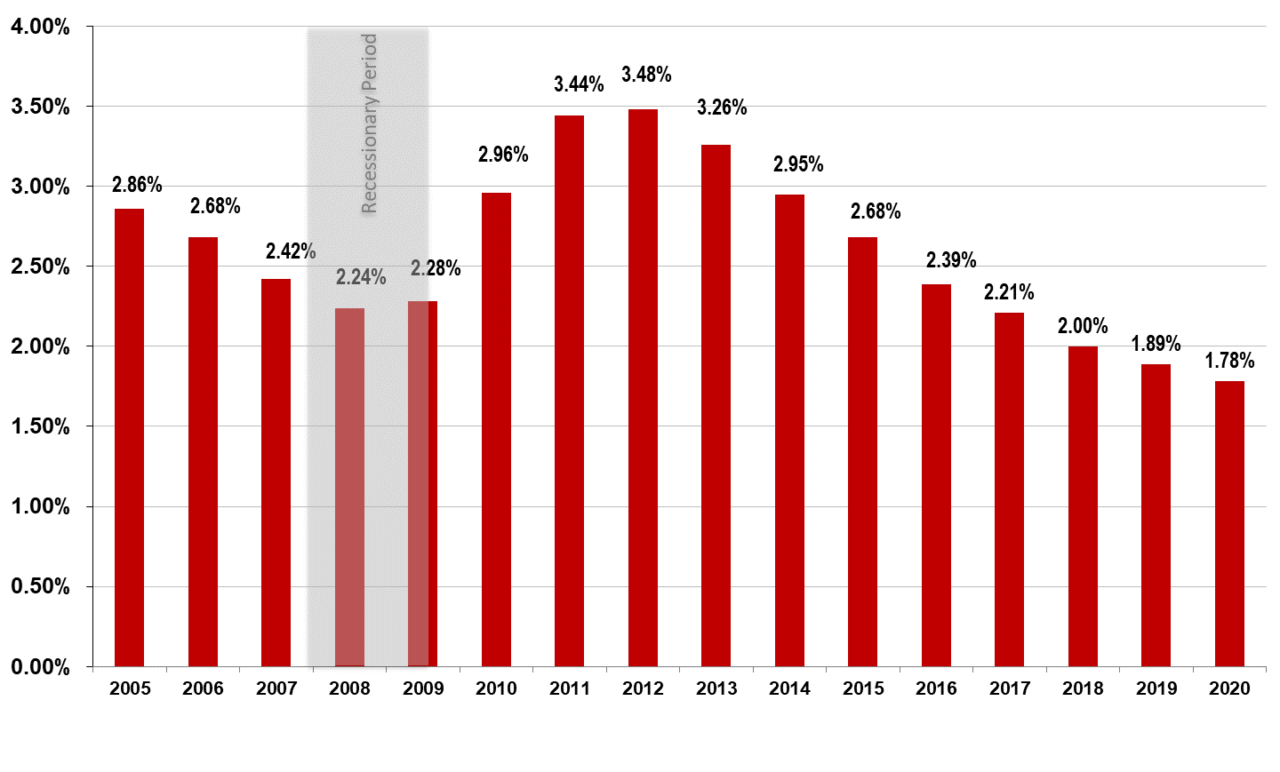

Suta Tax Rate Increase 2020 State By State Gusto

Suta Tax Requirements For Employers State By State Guide

New Employer Ui And Construction Employer Tax Rates For 2022 State Of Delaware News

Fast Unemployment Cost Facts For Washington First Nonprofit Companies

Futa Tax Overview How It Works How To Calculate

State Unemployment Insurance Tax Rates Tax Policy Center

View All Hr Employment Solutions Blogs Workforce Wise Blog

What Every Employer Must Know About State Unemployment Tax Quickbooks Data Migrations Data Conversions

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Fast Unemployment Cost Facts For Texas First Nonprofit Companies

How Do I Find My Colorado Ui Rate Asap Help Center

Tips For Reducing Your Business Suta Tax Rate Workest

Futa Tax Federal Unemployment Tax Act Definition Rate

Unemployment Insurance Taxes Iowa Workforce Development

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

2022 Federal State Payroll Tax Rates For Employers

Unemployment Claims Could Drive Up Taxes For Already Hurting Texas Businesses Keye

.png?width=1000&name=Paytime%20-%2030th%20Logo%20(Website).png)